We expect the French government to collapse following the no-confidence vote on Sep. 8th, resulting in the PM Francois Bayrou’s removal.

While the political turmoil may be reduced after the appointment of a new prime minister, the possible risks of escalation and ongoing challenges to resolve the deficit pose significant risk to French government bonds.

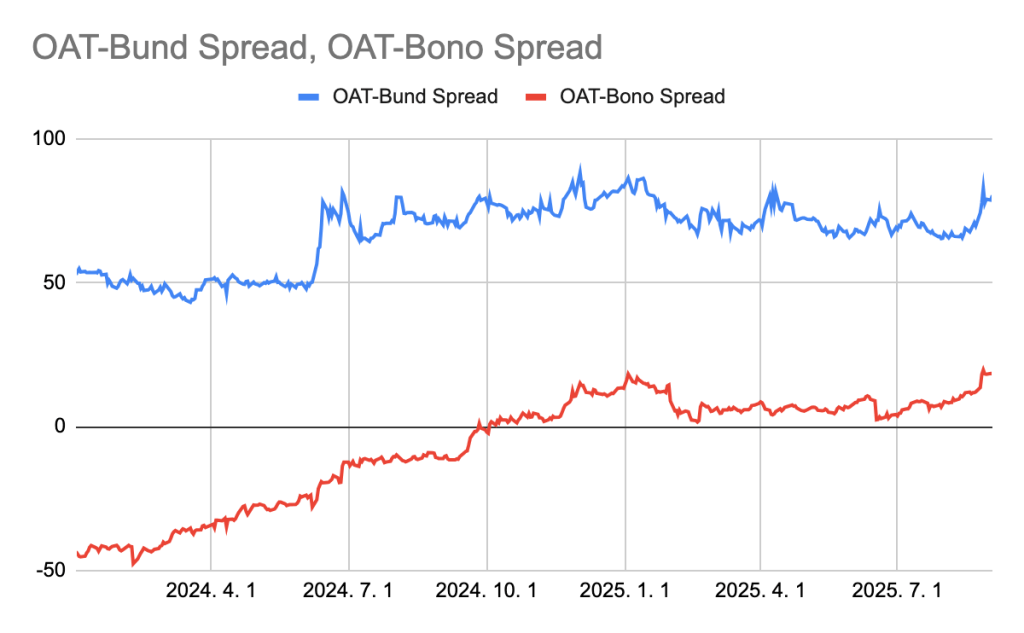

Given that fiscal conditions are crucial, especially for Eurozone government bonds, we believe the OAT-Bund spread will widen in the mid to long term.

Political Turmoil in France, perhaps a deja-vu?

Recent political developments in the EU’s second biggest economy have caused a huge shock in the bond market, a similar movement to what we observed last July to December. Back then, President Macron called for early parliamentary elections following the far-right Rassemblement National(RN)’s victory in the EU elections. Despite hopes of a dramatic comeback, Macron’s centrist Renaissance party with the Ensemble coalition has only secured 3rd place in the first round and 2nd place in the final round.

Subsequent to the election, the newly nominated Prime Minister, Michael Barnier soon faced challenges from the majority opposition parties. The deficit-slashing budget proposal in October 2024 provoked strong opposition and eventually a no-confidence vote against him.

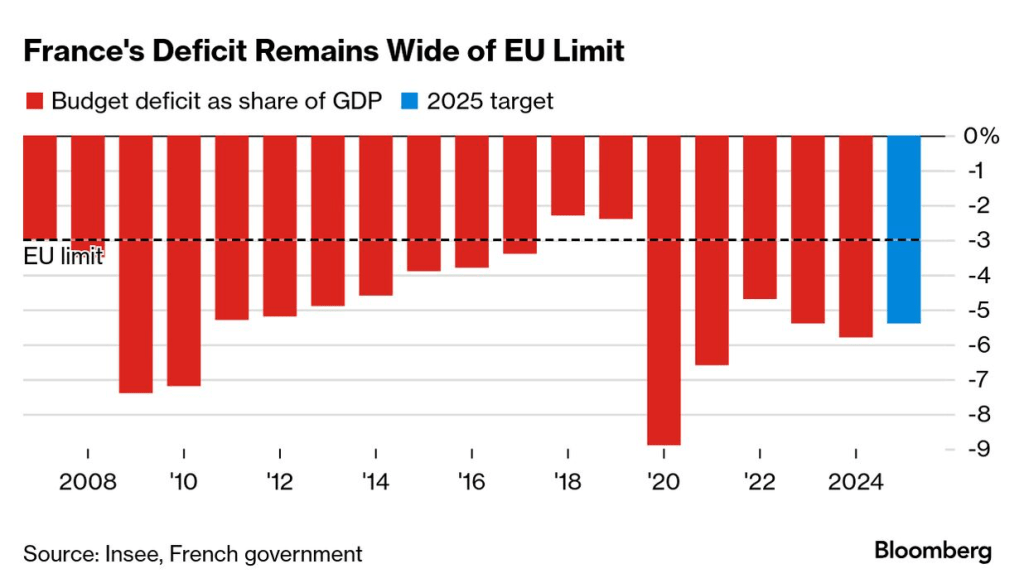

France has recently raised concerns in the market due to large government deficits, leading to worries about unsustainable debt. The budget deficit has reached 5.8% of GDP, well above the EU’s target of 3%. Although the government aimed to cut spending by 40 billion euros and increase tax revenue by 20 billion euros, it faced significant opposition from both the public and opposition parties.

September 8th, Crucial Moment for France

And fast forward to now – everything remains in the same place, except that for this time, the Prime Minister himself has decisively called for a confidence vote on September 8th to gain support for tackling the deficit problem. Prime Minister François Bayrou, succeeding Barnier, aimed for more assertive fiscal reform, lowering the government deficit to 4.6% in 2026 and to 2.8% by 2029, while keeping social programs minimally affected. “The issue, the question, is not the fate of the prime minister or … even the fate of the government. The question is the fate of France,” Bayrou said.

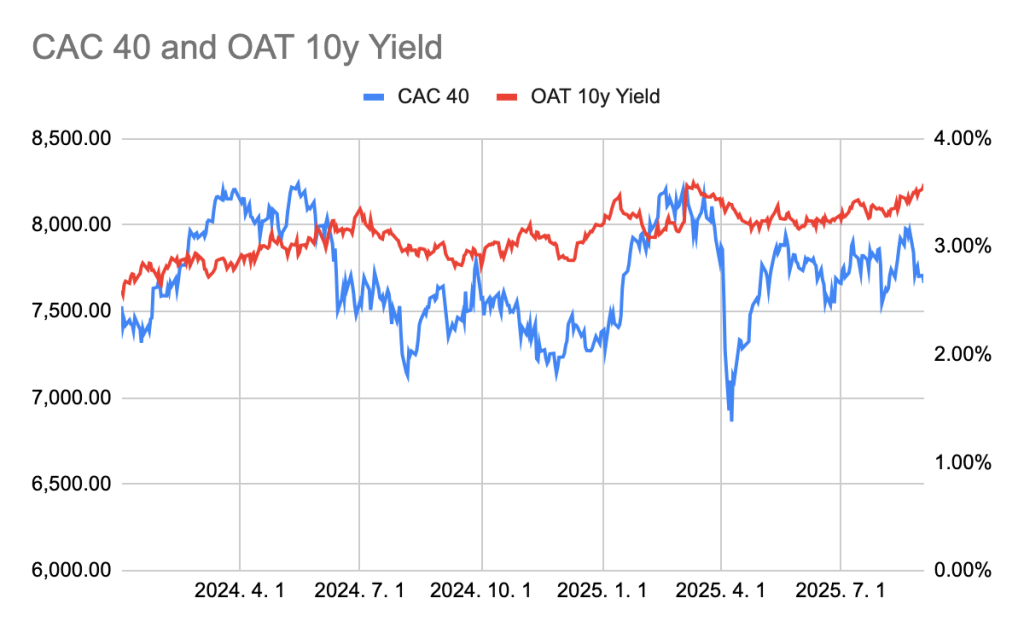

Despite Bayrou’s attempts, the opposition parties, which held more than 320 seats in the 577-seat National Assembly, remained firm, already announcing to vote against Bayrou. Many expect Bayrou’s government to collapse after the confidence vote; Polymarket data indicate that market participants assign a 94% probability of Bayrou no longer serving as Prime Minister by September, and a 96% probability by December. Financial markets also reacted fast to Bayrou’s announcement for a confidence vote, CAC 40 plummeted 3.26% over 2 days, and French 10 year bond yields rose to 3.6%, highest level since Eurozone financial crisis.

Eurozone Bond Yields: Primarily affected by Fiscal Conditions

While the market appears to have confidently priced the risk of the Prime Minister’s removal, we anticipate that the OAT-bund spread will likely widen further in the mid to long term. The primary reason for this conclusion is that Eurozone bond yields are significantly influenced by the fiscal conditions of the country, while being less impacted by factors such as inflation or economic growth.

Let’s start with a straightforward theoretical analysis of how macroeconomic factors influence bond yields. Typically, when inflation occurs, it leads to an increase in bond yields, which can be understood in two ways. First, investors would anticipate that the central bank would raise its policy rate, shifting towards a more restrictive monetary policy. This would have a greater impact on short-term interest rates than on long-term rates. Also, Investors would require higher nominal yields to offset the loss of real returns and purchasing power of the currency caused by inflation. This logic would result in the rise of long-term rates, which means that inflation could cause a bearish movement overall throughout the yield curve.

In addition, economic growth tends to have a positive correlation with the bond yield. This could also be understood in 3 ways. First, demand for credit is likely to be higher during economic prosperity than economic slowdown. Second, the central bank may tighten its monetary policy to prevent overheating. Third, investors may shift to riskier assets like equities, requiring higher compensation to hold government bonds.

However, note that France does not decide its monetary policy on its own; the policy rate is determined at the Eurozone level by the ECB, where France has limited control. In other words, domestic inflation alone may not directly translate into rate hikes. Additionally, inflation in France would not significantly reduce the purchasing power of the Euro. The real return on a Euro-denominated bond is based on the average yield of eurozone government bonds, unlike other government bonds like JGBs or T-bonds.

Therefore, inflation and economic growth, two primary factors influencing government yield bonds, have a reduced impact on Eurozone government bonds. Between 2020 and 2024, the correlation coefficient between the US core Consumer Price Index (CPI) and the 10-year Treasury bond yield was recorded at 0.597. In comparison, the correlation coefficient for Germany’s core CPI and the 10-year Bund yield was lower, at 0.508. This might seem like a large number, but considering the fact that Eurozone’s inflation and ECB rate hikes coincided with US’s inflation and Fed’s rate hikes during the period, it is clear that Germany’s inflation alone had a relatively limited impact on its government bond yield. Additionally, there was no correlation found between France’s inflation rate compared to Germany and the 10-year OAT-Bund spread.

Long-term Widening of OAT-Bund Spread Expected

While the market has been assessing France’s risk of unsustainable debt levels and the political turmoil from the no-confidence vote, it has not fully considered the potential risks of escalation and the delay in addressing the deficit, in our view. The OAT-Bund spread is currently at 80 basis points, which is lower than the levels observed when Barnier’s government collapsed. French Financial Minister Eric Lombard stated, “I cannot guarantee that there is no risk of International Monetary Fund intervention.” Although ECB Chair Lagarde denied the possibility, such an escalation would lead to a severe rise in OAT rates. Another less severe risk is the potential for a downgrade of ratings, which is somewhat accounted for in current market prices.

Furthermore, while the market appears to be somewhat optimistic about a political change following the new prime minister, the delay addressing the fiscal deficit remains a significant issue. Since President Macron is unlikely to appoint an advocate of accommodative fiscal policy as the prime minister, political gridlock will likely continue. The leading opposition party RN, a strong advocate for tax cuts, is gaining popularity and increasing its chances of being elected in the 2027 presidential election.

We envisage the yields on OATs will continue to rise, exceeding previous highs in the OAT-Bund spread in the medium term. Additionally, the spread between OATs and Bonos is expected to widen, as Spain has implemented fiscal reforms over the past few decades and successfully reduced its government deficit to stable levels.

Leave a comment